Obtain All Your Questions Regarding Home Mortgages Responded To Here

Article written by-Huynh SlaughterIf you're looking into home mortgages, then you surely are excited. It's time to buy a home! However, what you might realize is there is quite a lot of information to take in, and how do you sort all of this out to get to the mortgage company and product that you need? Keep reading to find out how to do this.

Have at least 20 percent of the purchase price saved. Lenders will want to verify that you have not borrowed the money, so it is important that you save the money and show deposits into your checking or savings account. Down payments cannot be borrowed; thus it is important to show a paper trail of deposits.

If you are considering quitting your job or accepting employment with a different company, delay the change until after the mortgage process has closed. Your mortgage loan has been approved based on the information originally submitted in your application. Any alteration can force a delay in closing or may even force your lender to overturn the decision to approve your loan.

If you are a veteran of the U.S. Armed Forces, you may qualify for a VA morgtage loan. These loans are available to qualified veterens. The advantage of these loans is an easier approval process and a lower than average interest rate. The application process for these loans is not often complicated.

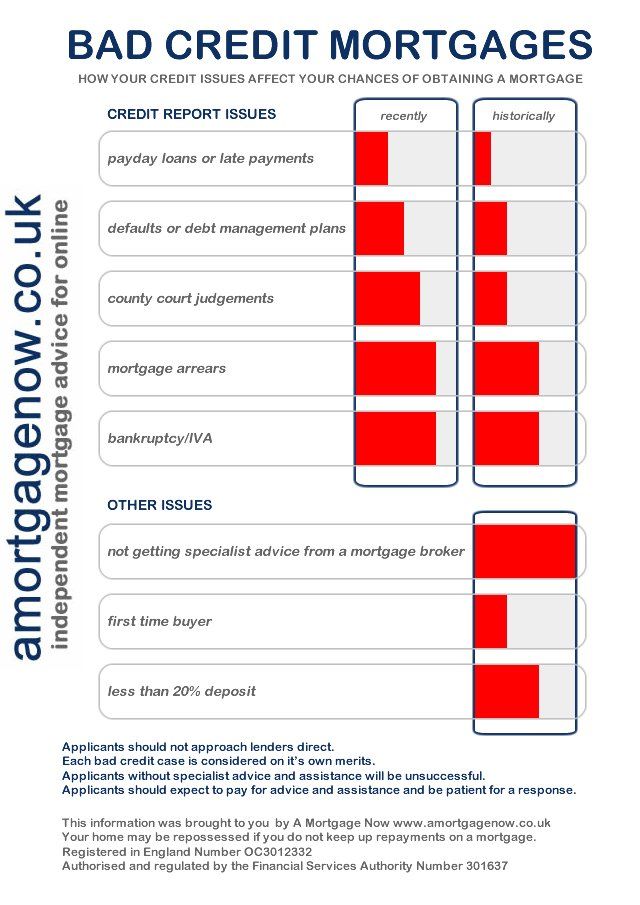

Some creditors neglect to notify credit reporting companies that you have paid off a delinquent balance. Since your credit score can prevent you from obtaining a home mortgage, make sure all the information on your report is accurate. You may be able to improve your score by updating the information on your report.

If you are offered a loan with a low rate, lock in the rate. Your loan may take 30 to 60 days to approve. If you lock in the rate, that will guarantee that the rate you end up with is at least that low. Then you would not end up with a higher rate at the end.

If your mortgage has been approved, avoid any moves that may change your credit rating. Your lender may run a second credit check before the closing and any suspicious activity may affect your interest rate. Don't close credit card accounts or take out any additional loans. Pay every bill on time.

If your application for a loan happens to be denied, don't lose hope. Instead, check out other lenders and fill out their mortgage applications. Each lender can set its own criteria for granting loans. That is why it can be better to apply with more than one of them to obtain the best results.

Before you begin home mortgage shopping, be prepared. Get all of your debts paid down and set some savings aside. You may benefit by seeking out credit at a lower interest rate to consolidate smaller debts. Having your financial house in order will give you some leverage to get the best rates and terms.

If you're paying a thirty-year mortgage, make an additional payment each month. The extra money will go toward the principal. Making extra payments early can help the loan get paid off faster and reduce your interest amount.

Carefully check out the reputation of a mortgage lender before you sign the final papers. Do not put all of your trust in the mortgage lender. Ask friends and family. Browse on the web. Check out lenders at the BBB website. You have to know as much as possible before you apply.

Do not take out a mortgage loan for more than you can comfortably afford to pay back. Sometimes lenders offer borrowers a lot more money than they need and it can be quite tempting since it would help you purchase a bigger house. Decline their offer because it will lead you into a debt pit you cannot get out of.

Put as much as you can toward a down payment. Twenty percent is a typical down payment, but put down more if possible. Why? The more you can pay now, the less you'll owe your lender and the lower your interest rate on the remaining debt will be. It can save you thousands of dollars.

Shop around for the best mortgage terms. Lenders individually set term limits on their loans. By shopping around, you can get a lower interest rate or lower down payment requirements. When shopping around, don't forget about mortgage brokers who have the ability to work with multiple lenders to find you the best rate.

Before applying for a mortgage, whittle down how many credit cards you own. If https://www.forbes.com/advisor/banking/best-business-checking-accounts/ have a lot credit cards, it can make you appear that you have too much debt. Have as few cards as possible.

Ask around about mortgage financing. You may be surprised at the leads you can generate by simply talking to people. Ask your co-workers, friends, and family about their mortgage companies and experiences. They will often lead you to resources that you would not have been able to find on your own.

You can save money on a mortgage by going with a lender who offers to finance with no closing costs. Closing costs are a significant part of a mortgage. To make up for that lost money, however, the lenders will make up it in some other way. Usually with a slightly higher interest rate.

There are times when the seller of a home will be able to give you a land contract so you can purchase the home. The seller needs to own the home outright, or owe very little on it for this to work. A land contract may need to be paid within a few years.

When the bank asks a question, be honest. It is a terrible idea to lie when applying for mortgage loans. Never misstate assets or income. If you do you could find yourself saddled with more debt than you can actually afford to pay. It may seem good in the moment, but in the long-run it will haunt you.

Clearly, it is very challenging to understand the home mortgage process. You can be successful if you spend the necessary time to understand the many details of the financing process. Utilize the advice in this piece and never stop learning more.